Unlock Savings: Get The Best Deals On Petrol Cars Road Tax Today!

Petrol Cars Road Tax: Understanding the Costs and Benefits

Dear Readers,

Welcome to this comprehensive guide on petrol cars road tax. In this article, we will delve into the intricacies of road tax for petrol cars, providing you with all the essential information you need to know. Whether you’re a car owner or simply curious about the subject, this article will serve as an invaluable resource.

2 Picture Gallery: Unlock Savings: Get The Best Deals On Petrol Cars Road Tax Today!

Introduction

1. What is Petrol Cars Road Tax?

2. Who is Responsible for Paying Petrol Cars Road Tax?

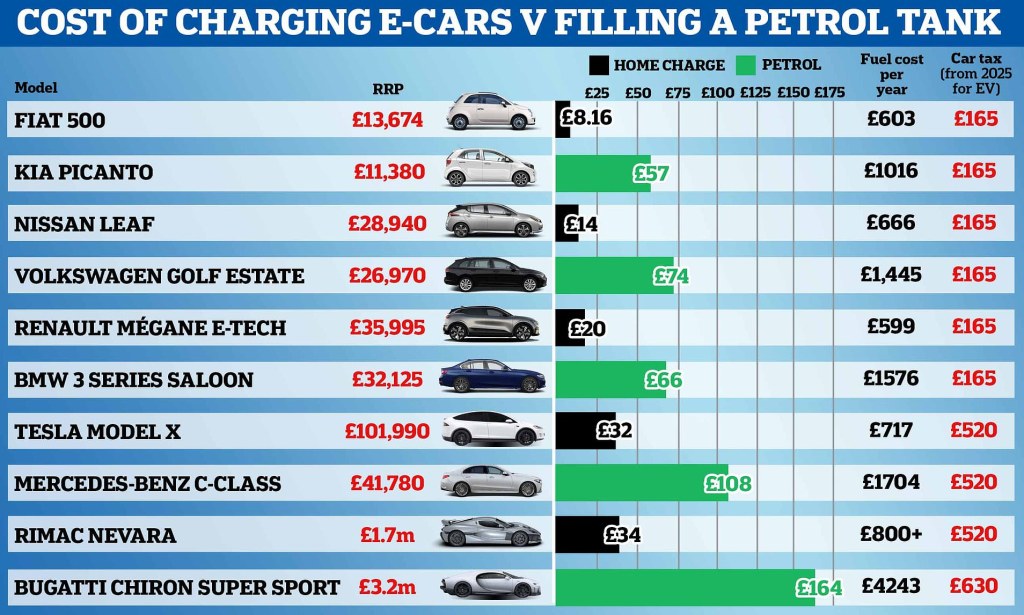

Image Source: buyacar.co.uk

3. When is Petrol Cars Road Tax Due?

4. Where Can I Pay Petrol Cars Road Tax?

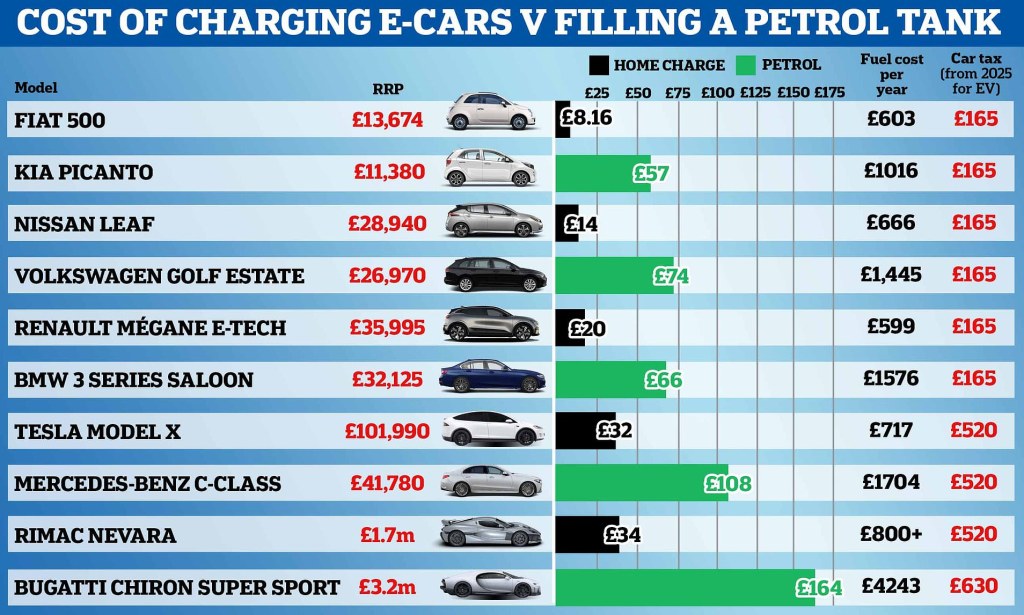

Image Source: dailymail.co.uk

5. Why is Petrol Cars Road Tax Necessary?

6. How is Petrol Cars Road Tax Calculated?

What is Petrol Cars Road Tax?

Petrol cars road tax, also known as vehicle excise duty, is a tax imposed by the government on car owners. The primary purpose of road tax is to generate revenue for the government while also incentivizing the use of environmentally friendly vehicles. The amount of road tax you need to pay depends on various factors, including the type of vehicle, engine size, and CO2 emissions.

Who is Responsible for Paying Petrol Cars Road Tax?

The responsibility of paying petrol cars road tax lies with the registered owner of the vehicle. Whether you’ve just purchased a new car or acquired a used one, it is your duty to ensure that the road tax is paid on time. Failure to do so can result in penalties, fines, and even the suspension of your vehicle registration.

When is Petrol Cars Road Tax Due?

Petrol cars road tax is typically due annually. The specific due date depends on when your vehicle was first registered. You can find this information on your vehicle registration document or logbook. It is crucial to pay your road tax on time to avoid any legal complications.

Where Can I Pay Petrol Cars Road Tax?

Paying your petrol cars road tax is a straightforward process. You can pay online through the government’s official website or visit a local post office. Some banks also offer road tax payment services. Make sure to have your vehicle registration number and necessary documents ready when making the payment.

Why is Petrol Cars Road Tax Necessary?

Petrol cars road tax serves several important purposes:

1. Revenue Generation: Road tax is a significant source of revenue for the government, which is used for various public services and infrastructure development.

2. Environmental Considerations: By incorporating CO2 emissions into the road tax calculation, the government encourages the use of eco-friendly vehicles and discourages the use of high-polluting cars.

3. Road Maintenance: The funds generated from road tax are allocated towards the maintenance and improvement of roads, ensuring safer and smoother journeys for everyone.

How is Petrol Cars Road Tax Calculated?

The calculation of petrol cars road tax involves multiple factors, including the vehicle’s engine size and CO2 emissions. Generally, cars with higher CO2 emissions and larger engine sizes attract higher road tax rates. The government provides a comprehensive table that outlines the exact rates for different vehicle types. It is advisable to consult this table or use online road tax calculators to determine the exact amount you need to pay.

Advantages and Disadvantages of Petrol Cars Road Tax

Advantages:

1. Environmental Incentive: By incorporating CO2 emissions into the road tax calculation, petrol cars road tax encourages the use of cleaner vehicles, contributing to a greener and healthier environment.

2. Revenue Generation: The funds generated from road tax are essential for financing various public services, such as healthcare, education, and infrastructure development.

3. Road Maintenance: Road tax plays a crucial role in ensuring the upkeep and improvement of roads, providing safer and more efficient transportation for all road users.

Disadvantages:

1. Financial Burden: Road tax adds to the overall cost of owning a car, which may cause financial strain for some individuals.

2. Complexity: The calculation of road tax can be complex, especially when considering factors such as CO2 emissions and engine size. This complexity may require additional research or assistance to determine the exact amount owed.

Frequently Asked Questions (FAQs)

1. Is road tax applicable to electric cars?

Answer: No, electric cars are exempt from road tax as they produce zero emissions.

2. Can I pay my road tax in installments?

Answer: It depends on your country’s regulations. Some jurisdictions allow for installment payments, while others require the full annual payment upfront.

3. What happens if I fail to pay my road tax on time?

Answer: Failure to pay road tax on time can result in penalties, fines, and the suspension of your vehicle registration. It is essential to settle your road tax obligation promptly.

4. Are there any discounts or exemptions available for road tax?

Answer: Certain countries provide discounts or exemptions for low-emission vehicles or individuals with disabilities. Check your local regulations for more information.

5. Can I transfer my road tax to a new owner if I sell my car?

Answer: In most cases, road tax is non-transferable. The new owner will need to pay the road tax based on their vehicle’s registration details.

Conclusion

In conclusion, understanding petrol cars road tax is crucial for every car owner. It not only ensures compliance with legal requirements but also contributes to environmental sustainability and the overall well-being of society. By paying road tax on time and considering the environmental impact of your vehicle, you can play your part in creating a cleaner and safer future.

Take action today by checking your road tax due date and making the necessary arrangements for payment. Remember, a responsible car owner is not only concerned about their vehicle’s performance but also their contribution to society.

Final Remarks

Dear Readers,

We hope this article has provided you with valuable insights into petrol cars road tax. It is important to note that road tax regulations may vary between countries, so it is always advisable to consult your local authorities or official websites for the most accurate and up-to-date information.

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered legal or financial advice. Always consult with the relevant authorities or professionals for specific guidance regarding your road tax obligations.

This post topic: Fuel Efficiency Tips